[ad_1]

A huge story around the past two a long time has been the rise in residence rates. There are several variables at participate in. Restricted offer is just one. An inflow of individuals moving to a lot more fascinating locations is yet another. But climbing fascination charges are threatening to stymie the housing market place. There are even fears that some of the new gains could be reversed.

That has pushed home improvement shops Home Depot (Hd 2.38%) and Lowe’s (Small 2.09%) very well down below the highs they attained at the end of final 12 months. But those people fears may well be supplying investors an chance. Is one of them greater than the other? Wall Avenue thinks so. And these charts exhibit why.

Picture source: Getty Photographs.

A single is usually much more highly-priced than the other

For the earlier decade, Wall Road has been keen to pay back a higher valuation for House Depot than for Lowe’s. As the valuation of the all round inventory marketplace oscillated, the two property advancement merchants did a dance of extraordinary predictability. Resembling poles of two magnets repelling each and every other, the cost-to-product sales ratios kept their distance.

High definition PS Ratio data by YCharts

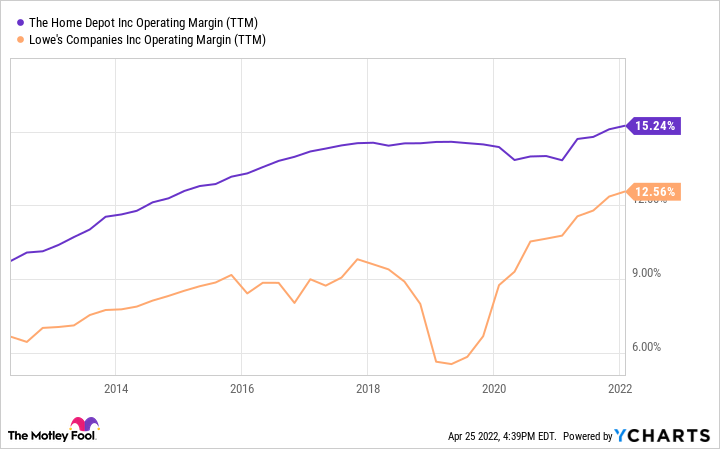

It really is also continually more profitable

A single great clarification is Dwelling Depot’s profitability. Over that 10 years, its functioning margin stayed at least 1-fifth larger than that of Lowe’s. The organization recently warned that revenue margins would go through as fees surge.

Management went so significantly as to charter its own cargo ship to avoid the snarled world offer chain. Traditionally, Lowe’s has expended a lot more on bills like gross sales, marketing and advertising, and administrative functions such as human resources and accounting. In 2021, the big difference was about a minimal extra than 2% of income — about the hole in operating margin.

High definition Working Margin (TTM) info by YCharts

In sharp contrast to historical past, the the latest update at Lowe’s was optimistic. In February it lifted its complete-12 months estimates for sales and revenue.

And it is in a superior situation to regulate its financial debt

Just one location where Lowe’s seems much more eye-catching is the total of personal debt it carries in comparison to Property Depot. It has $30 billion in merged small- and long-time period financial debt on its stability sheet. Property Depot has $45 billion.

But digging a minimal deeper reveals that House Depot is in a more powerful financial placement, due to the fact it generates practically twice the earnings ahead of desire and taxes (EBIT). That means its moments interest acquired ratio — the number of occasions the EBIT can go over annual interest payments — is considerably bigger.

Minimal Times Curiosity Gained (TTM) data by YCharts

It has grown quicker, far too

All of this neglects the 1 metric many buyers prioritize above all others: growth. Listed here way too, Household Depot wins. Neither organization is in hypergrowth mode, and each benefited a lot through the pandemic from consumers’ willingness to devote on housing. But more than the previous five- and 10-year durations, the major line at Loew’s has expanded at a slower tempo.

Hd Income (TTM) info by YCharts

Which a single pays you more to possess shares?

Buyers might hope Lowe’s to make up for these perceived shortfalls by paying a bigger dividend to shareholders. They would be erroneous. Home Depot’s distribution considerably exceeds that of Lowe’s. It has for most of the past decade.

Hd Dividend Generate info by YCharts

That does not account for all of the ways to return money to shareholders. Lowe’s has performed substantially far more stock buybacks in the previous handful of several years. In reality, it has repurchased 17% of shares outstanding in just the earlier three decades. Residence Depot has purchased back again just 6%.

Lowe’s also has a lot more area to maximize the dividend in the foreseeable future. It sends considerably less than one-quarter of gains back again to shareholders as dividends. For Home Depot, the range is about four-fifths. Nevertheless, both equally can simply do it for the foreseeable foreseeable future.

Is the shifting of the guard near?

If you happen to be searching to insert a single of the large-box household improvement merchants to your portfolio, the historic metrics make a powerful scenario for Dwelling Depot about Lowe’s. But that could be switching. Differing 2022 outlooks and an aggressive buyback system have Lowe’s on the lookout and sounding like the previous Property Depot that Wall Street fell in appreciate with.

Both of those give traders publicity to an sector at the coronary heart of the American economic climate. With robust capital return packages, good margins, and manageable credit card debt, there is no completely wrong option. But Household Depot has proved it can execute about time. That is why I would lean towards it if forced to pick. Of system, there’s no rule in opposition to purchasing both.

[ad_2]

Source connection