[ad_1]

The lockdowns of 2020 may possibly have prompted individuals to place far more funds towards their environment, boosting income for house improvement retailers Lowe’s (NYSE:Lower) and Residence Depot (NYSE:Hd), but the economic and housing availability crunches of 2022 are retaining them there.

Household furniture, electronics and property workplace set-ups aimed at building dwelling a superior spot to are living and work fueled 2020 obtaining, but with customers experiencing increasing expenses of gas and foodstuff, theyre likely to residence improvement shops to cope with repairs themselves and start gardens. This is preserving expansion at Lowe’s and Household Depot powerful, making them equally most likely profitable portfolio additions this summertime, in my viewpoint.

Both of those alternatives have growing dividend yields, creating them appealing for benefit buyers hunting to make passive money as well. Before you insert both of these house advancement shares to your portfolio, however, there are some negatives to contemplate.

Lowes

Lowes (NYSE:Reduced) is a home advancement retail chain operating in the U.S., Canada and Mexico. It features products and solutions for development, servicing, repairs and reworking. The housing market place may possibly be cooling a small from the highs of 2021, which could encourage projects in the residence youre in.

Revenues for the enterprise have doubled about the past ten years, and earnings for each share are expected to increase close to 13%. Lowe’s has a dividend produce of 1.66%, and the business has a lengthy monitor history of rising dividends. That could assist sweeten the offer for investors.

Analysts price Lowe’s a acquire, even nevertheless bulls consider the firm faces threats from climbing curiosity premiums, supply chain problems and flattening housing selling prices. Its well worth noting that the median age of houses in the U.S. is 39 years, an age when houses will have to have an escalating amount of money of servicing and could be candidates for transforming.

Lowe’s receives a GF Score of 96, pushed primarily by top ratings for profiability and growth.

House Depot

Surpassing forecasts in 9 of the last 10 quarters, another major U.S. residence advancement retailer, Dwelling Depot (NYSE:Hd), not long ago noted 10.7% expansion in net revenue 12 months-in excess of-yr.

House Depot counts specialist contractors amongst its major shoppers, and their massive-ticket purchases had been up 18% during the previous yr. EPS has grown 17% about the previous three a long time and income is up 8% about the past yr, getting it a acquire ranking from analysts.

Home Depot has a dividend yield of 2.26%, generating it the much more desirable of these two stocks for those people in look for of dividends.

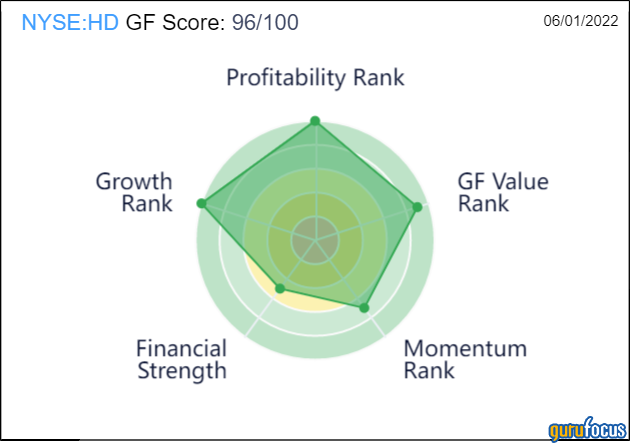

Like Lowe’s, Residence Depot also has a GF Score of of 96/100. In addition to higher development and profitability, it scores improved than Lowe’s for GF Benefit, however it loses points for weaker momentum.

This posting very first appeared on GuruFocus.

[ad_2]

Supply link