[ad_1]

Sundry Photography/iStock Editorial via Getty Images

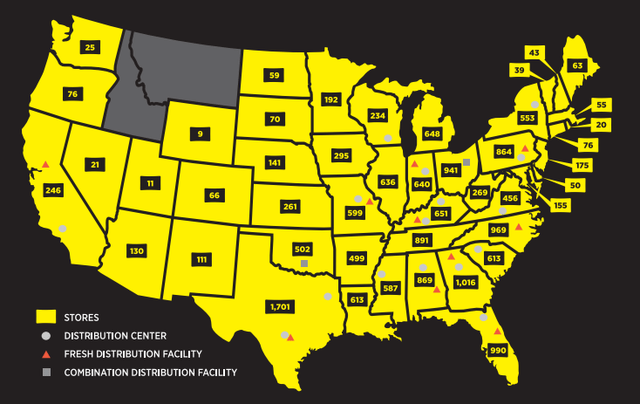

Dollar General (NYSE:DG) is a discount retailer with a huge footprint of over 18,000 stores across 46 states. Dollar General has the namesake Dollar General store that largely focuses on more rural locations as well as the pOpshelf stores that are being rolled out in the more urban/suburban areas.

Dollar General Store Locations (Dollar General 2021 Annual Report)

Dollar General is unique in that they are a mature retailer with a proven concept while still being in growth mode with 1,050 new stores opened in FY 2021 and plans to open 1,110 during FY 2022. That’s a huge footprint already and quite impressive growth in store counts.

The interesting thing about Dollar General, especially as fears of recession grow larger every day, is that Dollar General should be able to capture additional spend as consumers downshift to cheaper alternatives. That gives Dollar General a bit of anti-fragility to its business as people still need to shop for food and other home goods no matter what the economy is doing.

Dividend History

The core of my portfolio is invested in what I consider the “sweet spot” investments that carry a dividend yield in the 2.5% to 4.0% range with annual dividend growth normally in the 4% to 8% area. However, that doesn’t mean that I completely forego those lower yielding companies that are likely to carry on raising their dividend at a 10%+ annualized rate for years at a time.

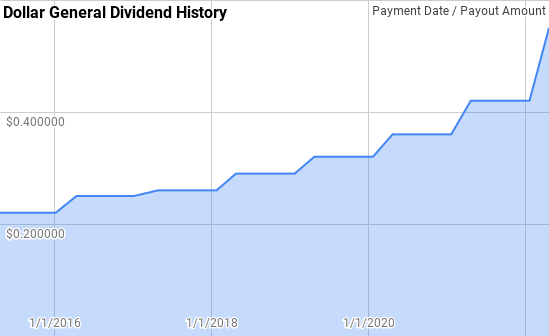

Dollar General Dividend History (DG Investor Relations)

Source: Author; Data Source: Dollar General Investor Relations

Dollar General is just a Dividend Challenger, with 7 consecutive years of dividend growth after initiating a dividend in 2015. Dividend growth has been strong over that time as would be expected for a nascent dividend streak.

Dollar General’s year over year dividend growth has ranged from 4.0% to 31.0% with an average of 14.2% and a median of 12.5%.

There’s been 5 rolling 3-year periods during Dollar General’s streak with annualized dividend growth ranging from 8.6% to 19.8% with an average of 12.5% and a median of 11.5%.

The rolling 1-, 3- and 5-year period annualized dividend growth rates from Dollar General since 2015 can be found in the following table.

| Year | Annual Dividend | 1 Year | 3 Year | 5 Year |

| 2015 | $0.880 | |||

| 2016 | $1.000 | 13.64% | ||

| 2017 | $1.040 | 4.00% | ||

| 2018 | $1.160 | 11.54% | 9.65% | |

| 2019 | $1.280 | 10.34% | 8.58% | |

| 2020 | $1.440 | 12.50% | 11.46% | 10.35% |

| 2021 | $1.680 | 16.67% | 13.14% | 10.93% |

| 2022 | $2.200 | 30.95% | 19.79% | 16.17% |

Source: Author; Data Source: Dollar General Investor Relations

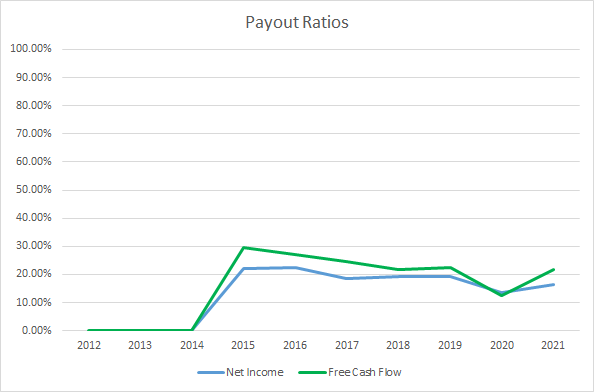

For dividend growth investors the payout ratio can be used as a quick gauge as to both the safety of the dividend in comparison to the profits or cash flow the business spits out. All else being equal I want to see a low payout ratio as that gives management the flexibility to maintain dividend growth at adequate rates during the inevitable hiccups to the business as well as allow for dividend growth to outpace growth in the underlying business.

DG Dividend Payout Ratios (DG SEC filings)

Source: Author; Data Source: Dollar General SEC Filings

Dollar General’s payout ratios are both very conservative. The 5-year average net income payout ratio is just 17.3% with the 3-year average at 16.3%. The average free cash flow payout ratios are 20.6% and 19.0%, respectively.

With Dollar General’s payout ratios falling slightly since 2015 there’s ample coverage of the dividend and plenty of room for dividend growth to run higher than the underlying growth in the business.

Quantitative Quality

A history of paying and growing dividends is just one data point that I use to try to narrow down potential investments. I also want to see how the business has performed across several different financial metrics to get a feel for the underlying business. Time is the friend of the great business.

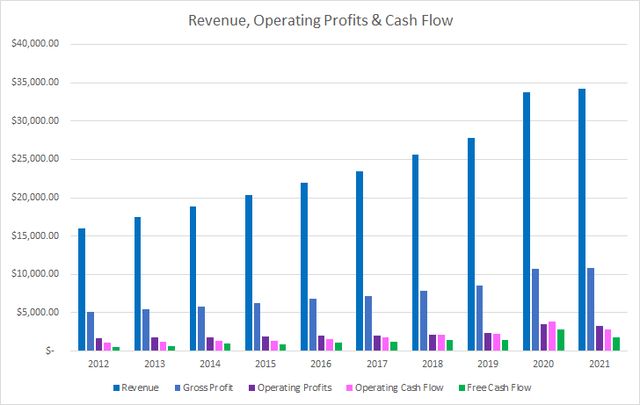

DG Revenue Profits and Cash Flow (DG SEC filings)

Source: Author; Data Source: Dollar General SEC Filings

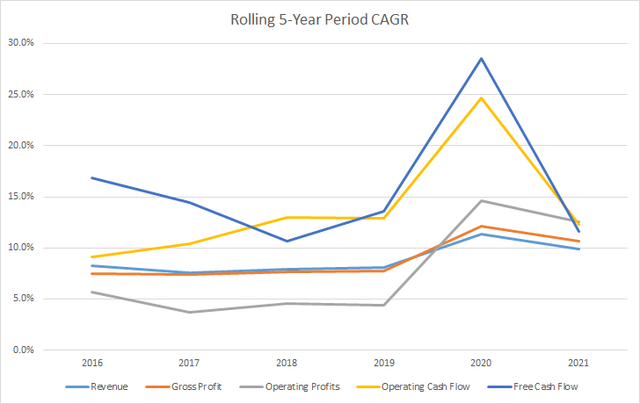

Dollar General’s revenue growth has been very impressive with it rising every year of the last decade due to both organic same store sales growth as well as the opening of additional store fronts. Over that time revenue grew 113.6% in total or ~8.8% annualized with gross profits tracking revenue growth increasing 112.6% or 8.7% annualized.

Operating profits have increased 94.8% over the last decade or 7.7% annualized with operating cash flow increasing an incredible 153.3% or 10.9% annualized. Dollar General’s free cash flow has exploded higher rising 220.7% or ~13.8% annualized far outpacing revenue growth.

The rolling 5-year period CAGRs for Dollar General’s revenue, gross and operating profits, and operating and free cash flow over the last decade can be found in the following chart.

DG 5 Year Financial CAGRs (DG SEC filings)

Source: Author; Data Source: Dollar General SEC Filings

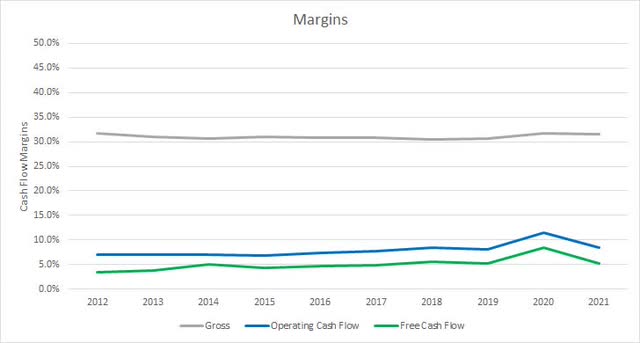

I want to see stable or increasing margins over time. Preferably free cash flow margins greater than 10%; however, the margin structure is largely set by the sector a business operates in rather than some secret sauce of management.

Dollar General Margins (DG SEC filings)

Source: Author; Data Source: Dollar General SEC Filings

Dollar General’s gross margins have been very steady over time with a 10-year and 5-year average of 31.0%. Free cash flow margins are still well below the 10% area that I like to see; however, that isn’t much of a surprise given that Dollar General is a brick and mortar retailer. The 10-year average free cash flow margin for Dollar General is 5.1% with the 5-year average at 5.9%.

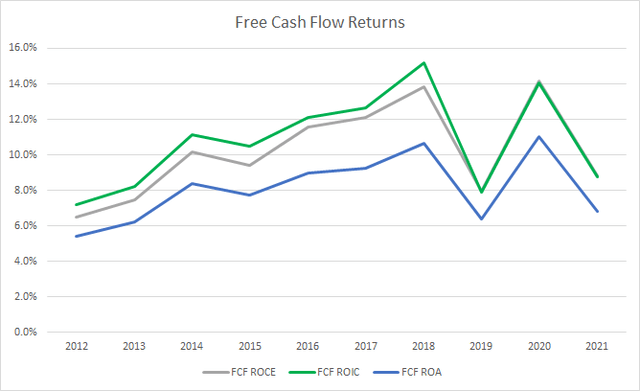

The free cash flow return on invested capital, FCF ROIC, is my preferred profitability metric. The FCF ROIC represents the annual return of excess cash the business is generating based on the capital currently invested in the business.

DG Free Cash Flow Returns (DG SEC filings)

Source: Author; Data Source: Dollar General SEC Filings

While Dollar General’s FCF margins aren’t up to the 10% level, their FCF ROIC has been greater than that mark in 6 of the last 10 years. The 10-year average FCF ROIC for Dollar General works out to 10.8% with the 5-year average at 11.7%.

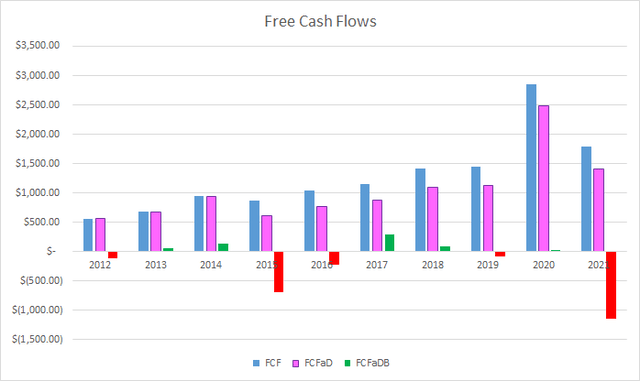

To understand how Dollar General uses its free cash flow I calculate three variations of the metric, defined below:

- Free Cash Flow, FCF: Operating cash flow less capital expenditures

- Free Cash Flow after Dividend, FCFaD: FCF less total cash dividend payments

- Free Cash Flow after Dividend and Buybacks, FCFaDB: FCFaD less net cash spent on share repurchases

DG Free Cash Flows (DG SEC filings)

Source: Author; Data Source: Dollar General SEC Filings

Over the last decade Dollar General has generated a cumulative total of $12.8 B in FCF. With that ample FCF they have paid out $2.2 B to shareholders in dividend payments which puts the 10-year FCFaD at $10.6 B. Management has opted to spend heavily on share repurchases using $12.2 B of their FCF to retire shares putting the 10-year cumulative FCFaDB at -$1.6 B.

Since Dollar General initiated their dividend in FY 2015 the 7-year cumulative cash flows are $10.6B, $8.4 B and -$1.7 B, respectively.

Share repurchases can be a great way for management teams to return excess cash to shareholders. I’m more partial to the special dividend route; however, I don’t expect to see a widespread adoption of that method. As such, instead of letting excess cash just build up on the balance sheet, management teams typically repurchase shares thus increasing remaining shareholders’ claim on the business.

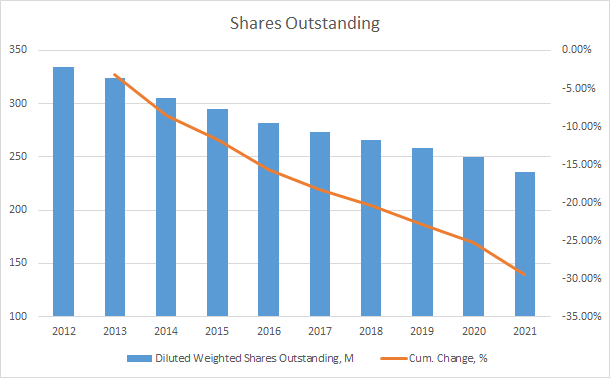

DG Shares Outstanding (DG SEC filings)

Source: Author; Data Source: Dollar General SEC Filings

As we saw with the free cash flow charts, Dollar General has typically returned all excess cash flow to shareholders. With that $12.2 B used on buybacks over the last decade, Dollar General has reduced its share count from 334.5 M for FY 2012 to 235.8 M for FY 2021. That’s a solid 29.5% total reduction or approximately 3.8% annualized.

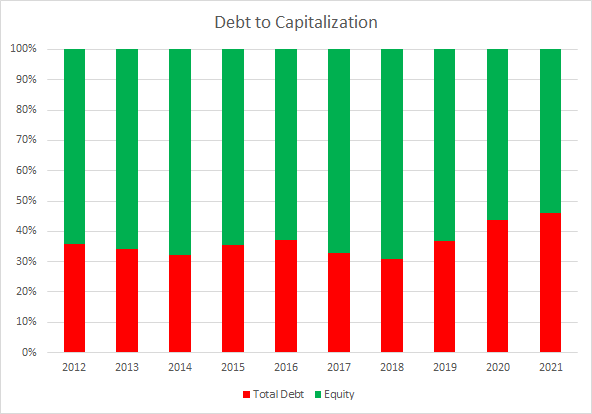

I also want to make sure that the balance sheet appears to be in solid shape. The debt-to-capitalization ratio lets you know how the business is structured in terms of debt and equity.

DG Debt to Capitalization (DG SEC filings)

Source: Author; Data Source: Dollar General SEC Filings

Dollar General’s debt-to-capitalization ratio has averaged 37% over the last 10-years and 38% for the most recent 5-year period.

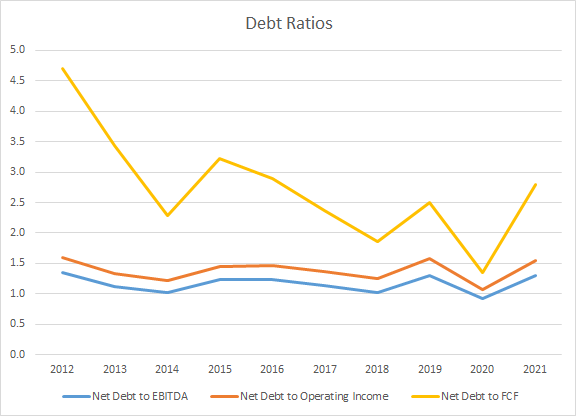

While the capital structure is something I look at, I place more emphasis on the net debt ratios. The net debt ratios examine total debt less cash versus some form of profit or cash flow metric. The net debt ratios give a better idea of the debt claims on the business.

DG Debt Ratios (DG SEC filings)

The ratios that I track are the net debt-to-EBITDA, -operating income, and -free cash flow. The 10-year average levels are 1.2x, 1.4x, and 2.7x, respectively. Accordingly the 5-year averages are 1.1x, 1.4x, and 2.2x.

Valuation

While Dollar General is a business that I do own I want to make sure that the valuation appears reasonable. I use several valuation methods in order to determine a potential fair value price range for the business. The methods that I use are the minimum acceptable rate of return, MARR, analysis, dividend yield theory, and a reverse discounted cash flow analysis.

A MARR analysis requires one to estimate the future earnings and dividends that a business will be able to generate. You then apply a reasonable, and conservative, terminal multiple at some future point to determine a likely market price and then calculate what the expected return would be. If the returns are greater than your threshold for investment and you’re comfortable with the quality of the business you can feel free to invest in said business.

Analysts expect Dollar General to have $11.44 in FY 2022 EPS and $12.49 in FY 2023 EPS. Dollar General is also expected to be able to grow EPS at a 10.9% rate over the next 5 years. I then assumed that earnings growth would slow to 6.0% annually for the following 5 years. Dividends are assumed to target a 20% payout ratio.

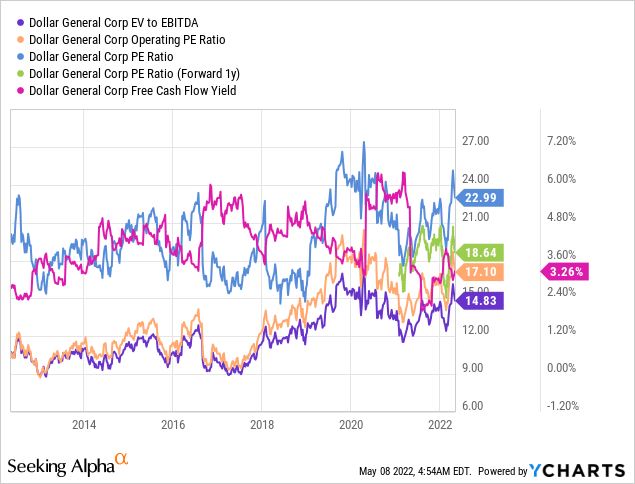

For the future expected multiple that Dollar General could be valued at I like to see how the market, collectively, has valued Dollar General over time. As we can see in the following YChart, Dollar General has typically traded between ~15x and ~23x TTM EPS. For the MARR analysis I’ll examine terminal multiples that span that range.

The following table shows the potential internal rates of return that an investment in Dollar General could possibly provide given that the assumptions laid out above prove to be reasonably close estimates of the growth of Dollar General’s earnings and dividends. Returns assume that dividends are paid and increased along the schedule that Dollar General has historically followed and that dividends are taken in cash. Returns also assume that shares are purchased around $233.56, Friday’s closing price.

| IRR | ||

| P/E Level | 5 Year | 10 Year |

| 25 | 16.2% | 11.3% |

| 22.5 | 13.6% | 10.2% |

| 20 | 10.9% | 8.9% |

| 17.5 | 7.8% | 7.5% |

| 15 | 4.4% | 5.9% |

Source: Author

Additionally I use the MARR analysis framework to reverse the process and determine what price I could purchase shares at today given the assumptions above and be able to generate the returns that I desire from my investment. My base hurdle rate is a 10% IRR and for Dollar General I’ll also examine 8% and 12% return thresholds.

| Purchase Price Targets | ||||||

| 10% Return Target | 12% Return Target | 8% Return Target | ||||

| P/E Level | 5 Year | 10 Year | 5 Year | 10 Year | 5 Year | 10 Year |

| 25 | $304 | $265 | $281 | $225 | $330 | $313 |

| 22.5 | $275 | $241 | $254 | $204 | $298 | $284 |

| 20 | $246 | $216 | $227 | $184 | $266 | $255 |

| 17.5 | $216 | $192 | $200 | $163 | $234 | $226 |

| 15 | $187 | $167 | $173 | $143 | $202 | $197 |

Source: Author

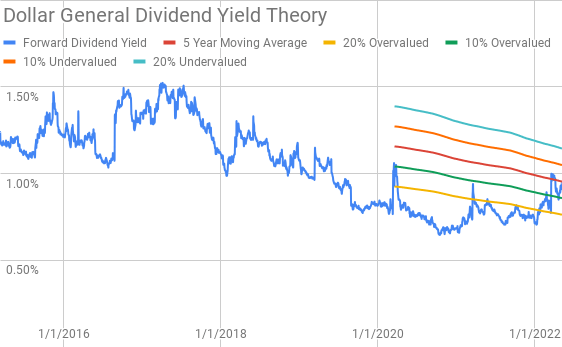

Dividend yield theory is a valuation method built around the dividend and reversion to the mean. The idea is that market participants, collectively, will value the business around a normal dividend yield. For Dollar General I’ll use the 5-year average forward dividend yield as a proxy for the fair value.

Dollar General Dividend Yield Theory (DG Investor Relations and Yahoo Finance)

Dollar General currently offers a forward dividend yield of 0.94% compared to the 5-year average forward dividend yield of 0.95%.

A reverse discounted cash flow analysis is a valuation model that can be used to decipher what the current market valuation implies about the future growth, margins and cash flows of the business. I use a simplified DCF model built on revenue growth, an initial free cash flow margin for Dollar General of 5.1% that increases to 6.0% during the forecast period, and a terminal growth rate of 4.0%.

Based on the margin profile from above with a 10% discount rate, Dollar General needs to grow revenues 11.4% annualized from FY 2021 through FY 2031. Lowering the discount rate to 8.0% reduces the required revenue growth to 5.7% annualized over that same timeframe.

Conclusion

Dollar General is a solid business that has proven the ability to continue to grow through both increased sales at existing stores as well as through opening additional store fronts. Dollar General focuses more on the forgotten consumers that live in small towns much to the benefit of investors.

Dividend yield theory suggests that Dollar General is currently fairly valued with a fair value range between $210 and $256. Meanwhile the MARR analysis suggests a fair value range between $216 and $275 with a 10% return threshold 5 years down the line and a terminal multiple between 17.5x and 22.5x.

The reverse DCF analysis implies that 10% returns are not likely from the current market valuation. However, 8% returns do appear reasonable with the possibility of share repurchases, if continued as they have in the past, being able to push the per share returns up into the low 10% range.

Dollar General is a solid company with plenty of future growth opportunities as they continue to build out the namesake Dollar General discount stores as well as the pOpshelf store concept. Dollar General is also currently a U.S. only business but is planning its first international expansion with up to 10 stores being opened in Mexico during FY 2022.

Dollar General appears to be trading around fair value at current levels so investors are likely to reap much of the future growth in terms of share price appreciation. While the dividend yield leaves a lot to be desired at just 0.94%, investors that can afford to allow the business to continue to grow, and of course increase its dividend, are likely to be very pleased with the results when looking out 5-10 years down the line.

I’ll continue to add to my position in Dollar General most likely through continued dollar cost averaging with any pullbacks to $200 or below being bought in larger size.

[ad_2]

Source link