[ad_1]

shapecharge/iStock via Getty Images

Earnings was the main theme for the week ending April 29, barring the two Chinese companies which took the top 2 spots.

The SPDR S&P 500 Trust ETF (SPY) -3.30% has been in the red for a month now (4 weeks in a row). YTD, the ETF is -13.26%. The Industrial Select Sector SPDR (XLI) -3.34% has been in the red now for five weeks straight. YTD, XLI -10.08%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +7% each. However, YTD, all the five stock are in the red.

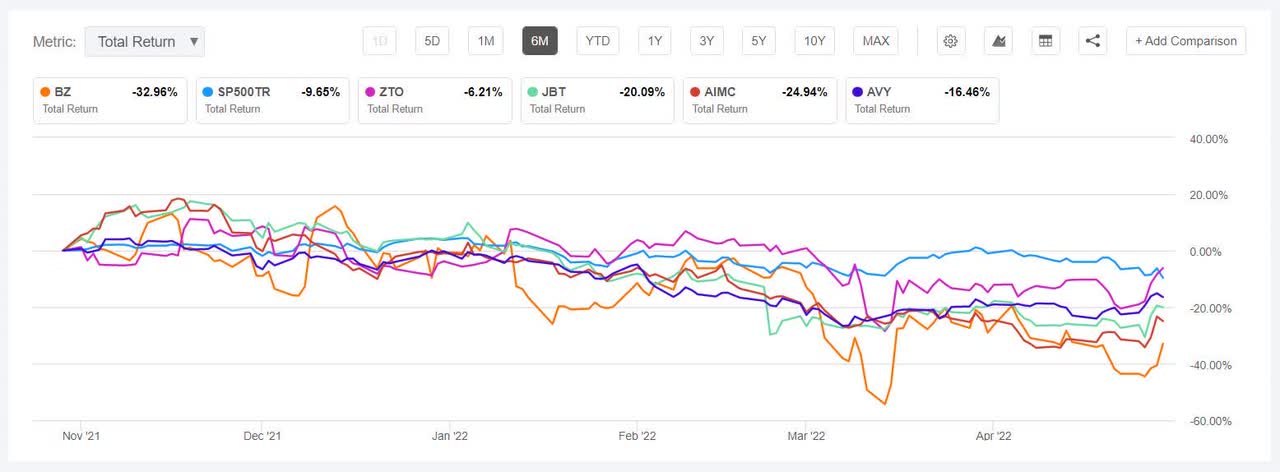

Kanzhun (NASDAQ:BZ) +18.72% leapfrogged from the decliners’ list it found itself in last week to take the #1 gainer tag. But this has yet again shown the volatile nature of the stock. The Chinese online recruitment platform was at #1 spot (+51.77%) for the week ending March 18 but only a week before that it was the worst performing stock (-26.62%) for the week ending March 11 and declined two weeks in a row. This week the stock gained the most on April 29 (+12.85%). However, YTD, the stock has fallen -32.54%. The Wall Street Analysts’ Rating is Buy with an Average Price Target of $37.91.

ZTO Express (ZTO) +17.97%. The Shanghai-based logistics services provider gained throughout the week. The Wall Street Analysts’ Rating is Strong Buy with an Average Price Target of $37.38.

The chart below shows 6-month total return performance of the top five gainers and SP500TR.

John Bean Technologies (JBT) +9.98%. The Chicago-based, company, which provides equipment to food and air industries, saw its stock rise on April 27 (+11.01%), the day after it reported its Q1 results, which beat analysts’ estimates. JBT’s Q1 revenue increased +12.3% Y/Y to $469M.

Altra Industrial Motion (AIMC) +9.43% gained the most after the company raised its FY22 outlook on April 28 (+10.60%) and reported its Q1 earnings, which beat analysts’ expectations. Earlier in the week, the Braintree, Mass.-based company said it was raising its quarterly dividend by 12.5% and plans to buy back up to $300M common shares through Dec. 31, 2024.

Avery Dennison (AVY) +7.87% reported non-GAAP EPS of $2.40 and revenue of $2.35B for Q1, both of which surpassed analysts estimates. The Glendale, Calif.-based adhesive manufacturer was increasingly bullish on prospects for 2022 after offering a more optimistic full-year earnings outlook on April 26. Later in the week, the company also announced that it was raising its quarterly dividend by 10%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -13% each. YTD, all these five stocks are in the red.

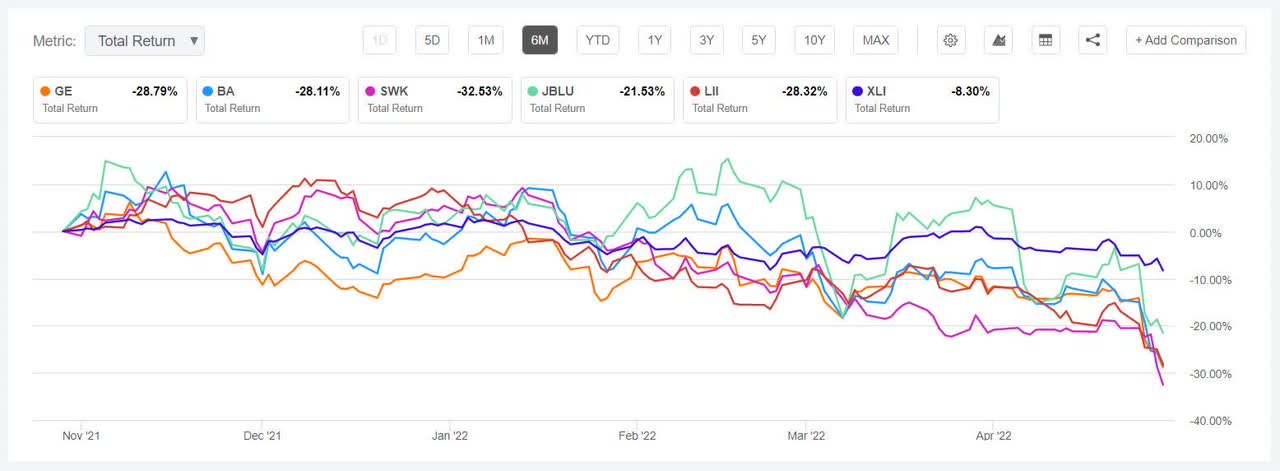

General Electric (NYSE:GE) -16.30% stock fell the most on April 26 (-10.34%) -10.3% in Tuesday’s trading, dropping to its lowest close since November 2020 in its biggest selloff in two years, after it said that it was trending toward the low end of its 2022 financial forecast as the company struggles with supply chain snarls and rising raw material costs. The company’s Q1 non-GAAP EPS of $0.24 beat analysts’ estimates but its organic revenue of $16.43B came in short of expectations. YTD, the stock has fallen -21.09%.

Boeing (BA) -15.87% posted a larger than expected Q1 loss and said it will pause production of its 777X plane through 2023. The aircraft maker’s steep Q1 earnings miss drew a flurry of analyst cuts to stock price targets – but no new downgrades. The stock was in the red throughout the week and YTD, has slumped -26.07%.

The chart below shows 6-month total return performance of the worst five decliners and XLI:

Stanley Black & Decker (SWK) -15.08%. The hardware manufacturer was dealt with a downgrade by Mizuho after Q1 revenue missed estimates and the company lowered its FY22 EPS outlook. Management noted significant inflation impacts ahead to prompt the pullback in guidance. YTD, the stock has declined -36.30%.

JetBlue Airways (JBLU) -14.45%. Despite a narrower than expected loss and a push beyond estimates on revenue, the company’s stock fell (April 26 -11.41%) amidst lingering concerns on operation capability. JPMorgan also took note and downgraded the airline’s stock to an Underweight rating from Overweight. YTD, the stock is -22.68%.

Lennox International -13.63%. The Texas-based provider of climate control products saw a flurry of analysts price target cuts over concerns related to rising interest rates given the stock’s exposure to the U.S. residential market. The company’s stock was in the red throughout the week but fell the most on April 26 (-6.22%) after the company reported its Q1 results, beating earnings estimates. Management also raised revenue growth guidance to 7-11% from 5-10%. YTD, the stock has declined -34.27%.

[ad_2]

Source link