Around the years, the inventory of inexpensive houses has been in sharp drop, although home prices have risen dramatically. With housing getting to be progressively unaffordable, the scarcity of risk-free and affordable properties is influencing a lot more and a lot more possible homebuyers each day. Nonetheless, likely impacts go outside of specific would-be house owners, with expanding implications for culture at substantial. This issue has no one particular answer, but with collaboration throughout the total housing market, collectively we can make extra possibility for a lot more men and women to realize sustainable, long-term homeownership.

Fannie Mae

Investigate shows that effective homeownership has quite a few advantages for the overall economy. For example, we have found that property owners are extra likely to commit in their area’s economy, get included in nearby government, and go on much more wealth to their small children. With normal wages raising by only 16% since 2012, and countrywide property prices escalating by 47%, the effects on long-time period, intergenerational financial perfectly-being could be sizeable.

Fannie Mae

Only 31% of potential homebuyers, aged 25-34, are assured they will be in a position to obtain a house in their selling price selection. In comparison with past generations, Millennials and Gen Z are coming into the market with greater amounts of debilitating personal debt. That, blended with the point that jobs are often concentrated in higher-charge locations, is delaying homebuying drastically. Furthermore, the increase of COVID-19 also provides sizeable difficulties. In a current Fannie Mae survey, 40% of present renters report obtaining expert a powerful effect on their general financial overall health thanks to the pandemic.

Fannie Mae

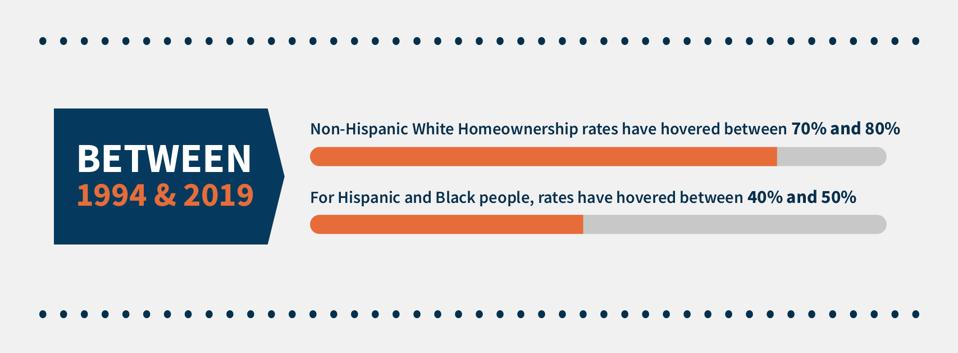

At the exact same time, census studies evidently illustrate the pretty real outcomes of racial inequality in housing. According to the U.S. Census Bureau, in between 1994 and 2019, Non-Hispanic White homeownership premiums hovered concerning 70% and 80%, although rates for Hispanic and Black persons remained involving 40% and 50%. As Fannie Mae CEO Hugh Frater states, “Fannie Mae understands the story of housing in America contains a history of systemic racism, and we know our job in housing finance provides essential obligations.”

So, what can we do to aid clear up these complications? Let’s share concepts, commence discussions, and work together to make housing much more inexpensive.

Fannie Mae thinks that housing ought to be attainable and sustainable for all. That is why we’re devoted to operating with our market associates and neighborhood organizations guiding this popular objective. Here’s our tactic:

Fannie Mae

See our infographic to study a lot more about why housing affordability matters.