[ad_1]

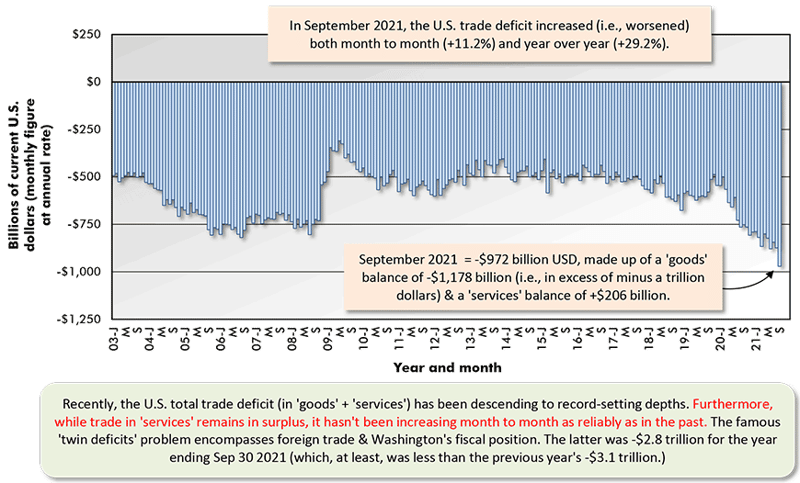

The international trade image in the United States has worsened considerably. The products trade equilibrium has deteriorated to -$1.5 trillion USD. Which is an all-time deepest degree.

Portion of the rationale lies with American customers. When work are abundant and incomes are climbing, purchaser buys soar and that pulls in a great deal of overseas-made goods. Traditionally, half the U.S. trade deficit is in client merchandise.

But an additional huge reason for the outsized soar in the U.S. products trade shortfall has been the dramatic rise in the international cost of oil. Both equally West Texas Intermediate (WTI) and Brent crude are back previously mentioned $100 USD for each barrel, right after yrs of languishing in the reduced reaches.

The charge of U.S. oil imports 12 months to day in 2022 is double what it was in 2021.

Canada continues to be the principal supplier of America’s oil imports. Canada at present holds a 63.1% (or almost two-thirds) share of the complete U.S. volume (calculated in barrels) drawn externally.

Also, the number of barrels of crude obtained from Canada is up calendar year to day, +4.8%, but not by as much as total imports, +10.8%. For Canada to substantially enhance its oil shipments to the United States would call for further expansions of the pipeline method, a idea which has experienced trouble obtaining traction with a lot of the environmentally sensitive American public and with the latest administration in Washington. In the short-time period, upping shipments by rail is the only practical reaction.

Specially noteworthy, however, has been the climb in oil imports from Saudi Arabia, +93.9% YTD. Extracting oil from the floor in Saudi Arabia is a relatively uncomplicated system and generation could be ramped up to lower the planet price, but MBS—Mohammed Bin Salman, the de facto ruler of the nation—has declined to choose that step.

A Frenetic Normal Fuel Market place & LNG Design

Different from oil is the increasingly frenetic organic gasoline current market. The rate of purely natural gasoline at the Henry Hub terminal has increased into the mid-$8.00 USD variety for each thousand cubic toes (from all-around $3.00).

But here’s the place matters turn in particular appealing. The value of natural gas in Europe is above $30.00 USD for each MCF. Since February 24, marking the invasion of Ukraine, Russia has turn out to be an outcast and the materials of its fuel to western markets have both been deliberately minimize off by Moscow or have become, on moral grounds, undesirable.

Germany, Italy, France, and other nations are trying to find alternative resources of provide. U.S. vitality companies are recognizing there’s a huge prospect, based on the two heightened international demand and the feedstock charge differential, to broaden liquefied normal gas manufacturing capability, with an pretty much certain shopper foundation throughout the Atlantic.

Tellurian’s Driftwood LNG task is the hottest mega-sized enterprise to enter ConstructConnect’s construction begins or groundbreaking studies. It carries a funds expenditure benefit (like machines) of roughly $20 billion.

The LNG exporting facility story, with accompanying on-internet site developing action, is only most likely to capture extra of construction’s ‘prime time’ information in the a number of several years forward.

A Hearty Strengthen to Construction from Canadian Foreign Trade

Contrary to the United States, the international trade photograph in Canada has enhanced significantly. Soon after a string of every month merchandise trade (i.e., items) balances that were being pretty much normally destructive, long lasting from mid-2008 to Spring-2021, there have been surpluses in 9 of the previous ten months.

Canada, a massive storehouse of resource sector prosperity, has benefitted from a typical revival in commodity selling prices internationally. The diploma to which Canadian export revenue have been vastly exceeding import purchases has been notably hanging in oil, coal, iron ore, copper, potash, aluminum, and forestry merchandise. Even fast glances at Graphs 7 as a result of 13 beneath can not enable but deliver this information house.

There have been periods in Canada’s record when the construction tale was largely pushed by mega useful resource tasks. That was surely the circumstance in the 00s when the Oil Sands tasks in Alberta taxed the development industry countrywide to the max. There have been remarkable demands for substance inputs and proficient tradespeople.

The following round of raw-products-centric design exercise is currently underway. A substantial LNG job, headed by Shell, is proceeding in NW British Columbia, with thought becoming provided to an eventual doubling of ability. Other LNG prospective clients are possibly in the operates or becoming mentioned for both coasts.

A giant potash mine (Jansen by BHP Billiton) has been approved in Saskatchewan.

Get the job done on a new gold mine (Greenstone by Equinox) is underway in Ontario.

3 hydrogen extraction crops (separately by Suncor, ATCO, and Air Goods & Chemical substances Inc.) are prepared in Alberta. They’ll draw hydrogen from all-natural fuel. A hydrogen plant (a Quebec Hydro and Thyssenkrupp joint enterprise) proposed for Varennes on the outskirts of Montreal will different hydrogen from water via electrolysis.

As well as, popping up as soon as again, there are several big power-relevant jobs to be mindful of (Dow petrochemical plant in Alberta Baie du Nord offshore oil to the east of St. John’s, Newfoundland, and Labrador).

For Canada, results in raw products internet trade is the vitamin nutritional supplement that fuels further excitement for all workers with construction in their DNA.

Graph 1

Graph 2

.png?width=800&name=U.S.%20Pic%20Chart%20(Mar%2022).png)

Desk 1

%20Table.png?width=800&name=U.S.%20Oil%20Import%20Suppliers%20(Mar%2022)%20Table.png)

Graph 3

.png?width=800&name=Canada%20Provinces%20Exports%20(Mar%2022).png)

Graph 4

-1.png?width=800&name=Canada%20(Mar%2022)-1.png)

Graph 5

.png?width=800&name=Canada%20Provinces%20Exports%20(Mar%2022).png)

Graph 6

.png?width=800&name=Canada%20Provincial%20Export%20Sales%20(Mar%2022).png)

Graph 7

%20Oil%20(Mar%2022).png?width=800&name=Can%20Commodity%20(1)%20Oil%20(Mar%2022).png)

Graph 8

%20Coal%20(Mar%2022).png?width=800&name=Can%20Commodity%20(5)%20Coal%20(Mar%2022).png)

Graph 9

%20Iron%20Ore%20(Mar%2022).png?width=800&name=Can%20Commodity%20(6)%20Iron%20Ore%20(Mar%2022).png)

Graph 10

%20Copper%20(Mar%2022).png?width=800&name=Can%20Commodity%20(7)%20Copper%20(Mar%2022).png)

Graph 11

%20Potash%20(Mar%2022).png?width=800&name=Can%20Commodity%20(10)%20Potash%20(Mar%2022).png)

Graph 12

%20Aluminum%20(Mar%2022).png?width=800&name=Can%20Commodity%20(11)%20Aluminum%20(Mar%2022).png)

Graph 13

%20Lumber%20(Mar%2022).png?width=800&name=Can%20Commodity%20(12)%20Lumber%20(Mar%2022).png)

[ad_2]

Source url